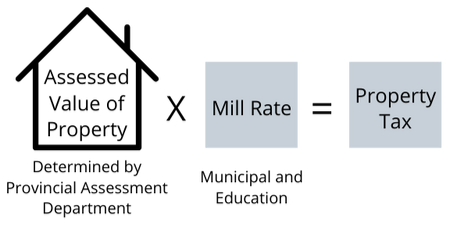

Property Tax BillsProperty Taxes are due October 15th Annual tax statements are mailed out in June. The amount of taxes indicated on your statement represents the amount due for the entire fiscal year (January 1 to December 31). The amount indicated on your statement is payable at par up to and including October 15th. Taxes paid after that date will be subject to a penalty at the rate of 1.25% per month. Change in OwnershipIf a change of ownership has occurred, please return the property tax bill to our office. Failure to receive a bill does not excuse an owner from the responsibility for payment of taxes or relieve the owner from the liability for any late fee penalties. Outstanding BalancesIf a portion of your previous year's taxes remain outstanding, this amount including a penalty calculated to the tax due date, is shown in the arrears/credits box on your tax statement. In the first week of December every year all outstanding utility balances will be transferred to the tax rolls. Notice will be sent a month prior to prevent the transfer. A second notice will be sent out should there be an outstanding amount transferred to the tax roll. QuestionsContact the Property Tax Clerk at 204-346-7124 or Submit a question or request | About Your TaxesProperty taxes are calculated by applying municipal and education mill rates against the portioned assessment of your property. Your annual tax statement is composed of two sections: municipal and education taxes.

|

Education Taxes

The Education Tax Levy is set by the Hanover School Division and makes up approximately 60% of your total tax bill. The Municipality is required by law to include these levies on the annual property tax bills. The RM of Hanover has no control over the school tax portion of your tax bill. Further inquiries may be directed to Hanover School Division at 204-326-6471.

Education Property Tax Credits

Farmland School Tax Rebate

Tax Sale - Properties in Arrears

Properties in arrears of any amount, for more than two years will be subject to the Tax Sale process. The Tax Sale process will add additional costs and fees that will greatly increase the amount owing.

All properties are redeemable until the public auction. There will be no redemption period once the tax sale, by public auction, has taken place. All property sales are final at the public auction.

Feel free to come into our office to discuss an action plan to resolve outstanding arrears. Remember, the sooner we have a plan in place the less additional costs and fees will be added.

For additional information or to discuss action plans email taxes@hanovermb.ca and include your property details and contact information or call 204-346-7124.